Understanding Buy, Sell, and Hold Ratings of Stock Analysts

Aug 26, 2024 By Kelly Walker

Advertisement

Investing in the stock market can be a great way to build wealth and increase your financial security, but understanding what you're investing in can be complicated.

One of the ways many investors look to get an extra edge is by paying attention to buy, sell, or hold ratings given by experienced stock analysts.

These ratings are important because they can provide helpful insights into which stocks may outperform the competition - however, interpreting them is only sometimes straightforward.

In this post, we will break down how professional stock ratings work and discuss why it's essential for serious investors to understand how these recommendations operate before making any major decisions about their portfolios.

What Buy, Sell, and Hold Ratings Mean for Stock Analysts.

Stock analysts provide buy, sell, and hold ratings to give investors insight into which stocks may outperform the competition. Understanding what these ratings mean is essential for making informed investment decisions

.

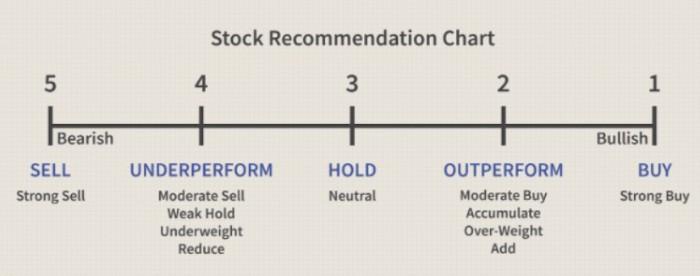

Buy ratings indicate that a stock should be purchased due to its potential for near-term growth. Sell ratings suggest that investors should sell their position in the stock because of current market conditions or other factors.

Hold ratings indicate that the stock is expected to remain relatively unchanged but may have some potential for growth over time.

It's important to remember that these ratings are subjective opinions of stock analysts and do not guarantee performance or success. It's still important to do your research and ensure you're comfortable with the risks involved in investing.

Knowing how stock analysts rate stocks can provide valuable insight into which investments may suit your portfolio. By understanding buy, sell, and hold ratings, investors will be better equipped to make informed investment decisions.

How to Interpret Buy, Sell, and Hold Recommendations.

Interpreting buy, sell, and hold recommendations from stock analysts is an important skill for any investor.

Buy ratings indicate that the analyst believes a stock is undervalued and likely to increase in price, while sell ratings indicate the stock may be overvalued and ready to decline. Hold ratings are given when the analyst believes that a stock's current value is about right.

In addition to understanding the difference between these ratings, investors should consider other factors, such as the analyst's past performance and track record of making accurate predictions.

Analysts may use different metrics when evaluating stocks, so it's important to understand how each one works and what information they provide. Additionally, investors should know analysts may have different opinions on the same stock.

Finally, it's important to remember that ratings from stock analysts are only one tool in an investor's arsenal. Even with the best information, no one can guarantee a particular outcome for any given investment.

Ultimately, investors must do their research and make informed decisions based on their knowledge and instincts. By doing so, they can better understand how to interpret buy, sell, and hold recommendations from stock analysts.

Benefits of Understanding Buy, Sell, and Hold Ratings.

Increased Knowledge

Understanding stock analysts' buy, sell, or hold ratings can help you better understand an investment's overall prospects. Accurately interpreting these ratings and what they mean for your investments can provide you with valuable knowledge that will enable you to make smarter investment decisions.

Stay Informed

Following stock ratings can help you stay up-to-date on the latest market trends and news, allowing you to better gauge how different stocks may be affected by current events or economic changes. This can help ensure your portfolio remains well-balanced and profitable in market conditions.

Reduced Risk

Investors can reduce their risk of making poor investment decisions by paying attention to stock analyst ratings. Analysts look at many important factors, such as a company’s financial statements, management team, and industry trends, when making their ratings which helps minimize the risk of investing blindly without understanding the full scope of information available.

Wealth Building Opportunities

Using stock ratings to identify potential investment opportunities can be a great way to build wealth over time. Following the analyst’s advice and investing in stocks with strong buy or hold ratings can yield greater returns for investors as these stocks tend to outperform their competition.

Alerts & Updates

Paying attention to stock analysts’ ratings lets you stay current on any alerts or changes analysts make throughout the year. For example, if an analyst lowers their rating of a particular stock, it might be wise for investors to take action and sell before any further losses are incurred.

Common Mistakes to Avoid when Interpreting Ratings.

Investing in the stock market can be a great way to build wealth and increase your financial security, but understanding what you're investing in can be complicated.

Understanding buy, sell, or hold ratings given by experienced stock analysts is one of the ways many investors look to get an extra edge.

Remembering these ratings is only sometimes straightforward, so avoiding common mistakes when interpreting them is essential.

For example, one should never take any rating as absolute truth; rather, use it as a guide for further research and analysis. Additionally, only rely a little on individual analysts' opinions - instead, try to look at multiple ratings from different sources.

Finally, stay up-to-date on current market conditions and news, as these will affect the performance of any stock you may be considering.

Strategies for Making the Most Out of Buy, Sell, and Hold Ratings.

Interpreting stock ratings can be daunting, so it’s important to understand the strategies professional analysts use when making buy, sell, and hold decisions.

Generally speaking, analysts look at quantitative information such as current financial statements, past performance metrics, and economic trends. They also consider qualitative factors such as a company’s management team and competitive marketplace position.

Analysts consider these factors when recommending buying, selling, or holding a particular stock.

Investors should stay current on any updates to the analyst's ratings to make the most out of these ratings. This means reading research reports associated with each rating and attending webinars or conferences hosted by the analysts.

Investors should also pay attention to major news events related to a company's stock, which can significantly impact a rating. With a comprehensive understanding of buy, sell, and hold ratings; investors can make more informed decisions about when to invest in stocks for maximum return.

By staying up-to-date on stock analyst ratings and their associated research, investors have everything they need to make the most out of their investments in the stock market.

FAQs

What does an analyst rating of hold mean?

Hold ratings are given when an analyst believes the stock's performance will likely remain stable. This does not necessarily mean that the stock will never go up or down - rather, it suggests that any price change is likely to be minor and temporary.

What does buy and sell ratings mean?

Buy ratings are given when an analyst believes the stock will likely increase in price over the near term. On the other hand, sell ratings suggest that the analyst believes it would be wise for investors to get out of a stock at current prices due to potential risks or future declines in value.

How reliable are analyst ratings?

Analyst ratings are useful in providing insight into the potential performance of a stock, but they should not be taken as gospel. Many factors can influence the success or failure of an investment, and no rating system is perfect.

Conclusion

Understanding stock analysts' Buy, Sell, and Hold ratings is necessary for making informed investment decisions. By understanding the evaluations analysts give, traders can interpret the analysis and make educated decisions that result in a good return on investment.

Stock analysts' ratings can also assist investors in diversifying their portfolios and making smarter investments that suit their risk tolerance levels.

Advertisement

Kelly Walker Aug 26, 2024

Understanding Buy, Sell, and Hold Ratings of Stock Analysts

62427

Sean William Jan 28, 2024

How to Hike Gertrude Saddle in Milford Sound

77786

Celia Kreitner Nov 07, 2024

Best Places in Spain for Solo Female Travelers

53465

Juliana Daniel Oct 02, 2023

Gili Islands Day Trip, Bali: An Adventure Awaits

44272

Juliana Daniel Nov 15, 2023

Explore Islands of Koh Samet: Getaway Options in Thailand

37684

Sean William Jan 27, 2024

How do you pack a kids travel bag

77353

Sean William Oct 28, 2023

Discovering the Wonders of Dodda Alada Mara

30072

Gabrielle Bennett Dec 03, 2024

Ultimate Guide to the Best Things to Do in Melbourne: From Landmarks to Hidden Gems

25139